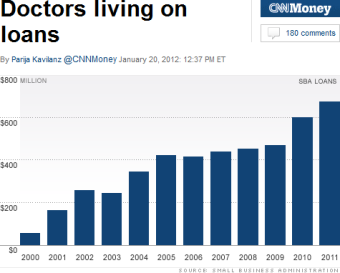

Doctors Living On Loans

CNN Money has a story about the increasing number of doctors living on SBA loans.

Read the entire story here

Dr. Bryan Glick, a family physician, took out a $198,000 SBA loan to start his own practice in Anthem, Ariz., shortly after graduating from his residency in 2009.

Doctors: Why we can't stay afloat

That loan sustained his practice for more than a year, but he still was not making money.

So he took over a concierge practice 30 miles away in Scottsdale. His concierge medical practice doesn't accept any insurance and charges an annual membership fee ranging from $3,000 to $5,000 for unlimited doctor visits and cell phone and e-mail access.

He continues to operate his traditional private practice. The concierge practice has helped Glick work off his SBA loan. He's now contemplating a second SBA loan to expand that practice.

Jasser has thought about the concierge model, too. But he acknowledged that it's not an option right now.

"Half of my patients are on Medicare," he said. "For economic and ethical reasons, I can't do it."

What's the cause? Certainly there are market forces at work, but there are also just basic business and economic changes that many physicians are having a great deal of trouble coping with; How to pay staff and make them more productive, how to structure their business, how to get paid, and how to attract the number of paients that they need.

There are titanic changes that have started and the speed with which they'll take effect will only increase. With change comes opportunity. Therer are plenty of docs who are doing just fine and makeing more money than every.

Physicians who cling to the old world will be destined to go down with the ship.

1 Comment

1 Comment